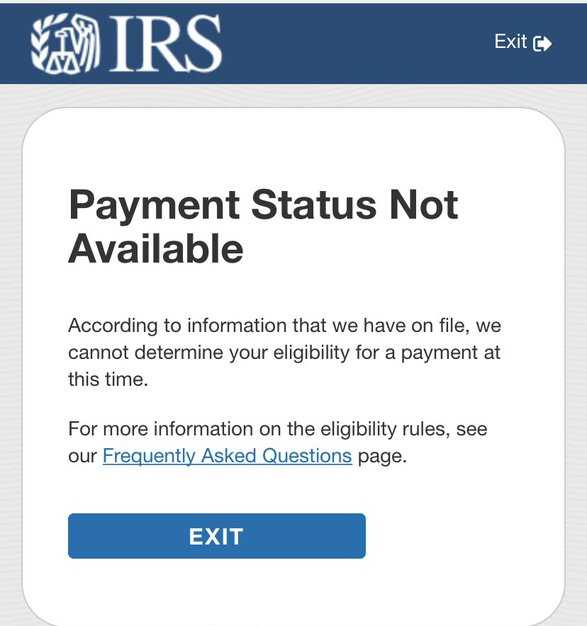

More information on determining eligibility, including income requirements here. Payment Status Not Available: We havent yet processed your payment or youre not eligible for a payment. Are federal benefit recipients as of December 31, 2020.Did not file a 2020 or 2019 tax return but registered for the first Economic Impact Payment using the special Non-Filers portal last year.Filed a 2019 tax return if the 2020 return has not been submitted or processed yet.According to the IRS, the agency will determine eligibility and issue the third payment to Americans who: Most Americans are eligible for the third stimulus payment. Problem #3: You are not eligible for the third stimulus payment

#Payment status not available how to

More details on how to update your information are on file here. If you do not provide updated account information, the IRS will not be able to reissue your payment. In order to have your payment reissued as a direct deposit, you can update information for a bank account, prepaid debit card, or an alternative financial product that can be associated with a routing and account number. The IRS says this means you were issued a check, rather than your payment being direct deposited into your bank account. If “Needs More Information” displays in your results, then your payment was returned because the Postal Service was unable to deliver it. "Payment Status Not Available" could also mean that the IRS "Needs More Information" to issue your stimulus payment. If you recently filed your return or provided information through Non-Filers: Enter Your Payment Info on. Problem #2: The IRS doesn’t have enough information to issue my stimulus payment If you are required to file a tax return and have not filed in tax year 2018 or 2019. The agency says it will regularly update recipients’ status information on its Get My Payment tool and recommends checking it daily for updates on payment status. The IRS will continue to issue $1,400 stimulus payments throughout 2021. How Some Rich Americans Are Getting Stimulus ‘Checks’ Averaging $1.Multiple People Shot at Alabama Church, Police Say IRS Explains Why Your Stimulus Check Payment May Be Different Amount Than Anticipated IRS Sends Stimulus Checks To 130 Million Largest Average Payment Was $1,944 In This State Get My Payment: IRS Formally Addresses What To Do If Your Stimulus Check Amount Was Wrong

In some ways, we should be thankful for the power of social media to help crowdsource potential solutions to this problem however, it is mind boggling that Americans need to resort to this strategy to get answers about money that desperately need. You may also want to keep a written log of each try so you remember which hacks you’ve tried and don’t waste a valuable login attempt repeating a futile option. The “Get My Payments” portal only lets you try to login three times per day so be strategic about which hacks you try first. Unfortunately, these hacks may not work in isolation and some, like typing in all caps and abbreviating words like “boulevard,” may need to be used in tandem. If you are using an older version of a website, it may also help to ensure you update to the newest version.Ĩ) Use The First Person’s Name On A Joint Returnįor those how filed a joint return, another suggestion, from the list compiled by Jessica Roy, is to enter only the first name on the return.įor anyone that may have a negative adjusted gross income, which is most prevalent for small business owners, try omitting the minus sign or parenthesis when inputting your 2018 or 2019 adjusted gross income. There hasn’t been an explanation on why this works, but it’s a suggestion cited in a few different spots that may be helpful. Used all caps and no St, and boom! Good to go!” She quotes a user who wrote, “on my address I was putting Center St and my return simply showed CENTER.

Jessica Roy of the LA Times included an anecdote of this within a compiled list of suggestions she released. When they typed what their tax return had documented, they successfully logged in. Some users were surprised to find that their address had been captured somewhat differently on their tax return than what they normally input. Mashable spoke to three independent programmers who confirmed that switching from lowercase to uppercase letters could make a difference, with one quoted as saying that typing in all caps is “a very common bug in systems that haven't been thoroughly tested.” This hack is not a panacea as some reported using it unsuccessfully, but it’s certainly worth a shot.ģ) Type Your Address Exactly As It Appears On Your Tax Return: However, there is credence to typing in upper case letters, mainly due to the programming language the IRS uses.

0 kommentar(er)

0 kommentar(er)